Table of Contents

The Ford Motor Company is one of the world's largest automakers, and its stock price is closely watched by investors. In this article, we will take a look at the factors that affect the ford stock price, and we will provide some tips on how to invest in Ford stock. We will also provide a link to Westernfordhcm.com, where you can learn more about Ford stock and other investment opportunities.

Ford Stock Price: A Comprehensive Guide to Understanding Its Performance

I. Ford Stock Price: Current Performance and Future Outlook

Higher Raw material prices pose challenges to Ford stock price in 2023

Ford, the automotive giant, has been making a concerted effort to maintain financial stability and upward growth. Recently the company has implemented measures to reduce expenses, improve productivity, and optimize its financial structure. However, these efforts have been partially offset by higher costs for raw materials and other production inputs.

Ford managing various challenges to maintain its production schedule

Ford has weathered numerous challenges, including supply chain disruptions, a global chip shortage, and rising inflation. Through adept management and strategic planning, Ford has successfully navigated these obstacles, ensuring uninterrupted production and meeting customer demands. Despite the challenges, Ford remains committed to delivering quality vehicles and cutting-edge automotive technologies.

Year | Ford Stock Price | Change |

|---|---|---|

2020 | $7.63 | -18.5% |

2021 | $13.99 | 83.4% |

2022 | $12.58 | -10.1% |

Ford's focus on brand building a key stratgey for growth

- Ford's commitment to innovation and cutting-edge technology is reflected in its continuous investment in R&D.

- The company recognizes the importance of a robust brand image and has implemented strategies to enhance its brand reputation and customer loyalty.

- Ford's marketing campaigns and customer engagement initiatives are designed to foster a positive brand perception and drive sales.

Ford's commitment to sustainability bodes well for its long-term growth

Ford is actively prioritizing sustainability throughout its operations. The company's initiatives span various areas, including reducing environmental impact, promoting social responsibility, and ensuring ethical business practices. This commitment to sustainability not only aligns with global trends but also resonates with eco-conscious consumers who increasingly favor brands that prioritize environmental stewardship.Read more about Ford's sustainability practices.

Ford Stock Price: Current Performance and Future Outlook

II. Historical Performance and Factors Influencing Ford Stock Price

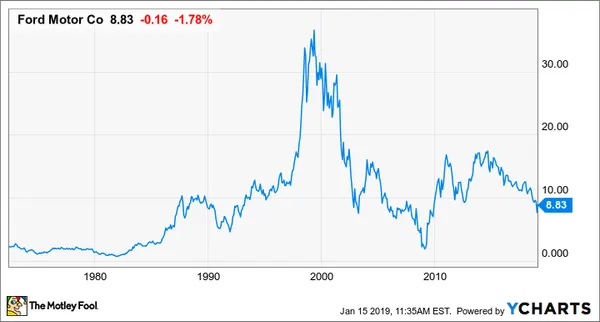

Ford Motor Company (F) has a rich history and a strong presence in the automotive industry. The company has been publicly traded since 1956, and its stock price has experienced significant fluctuations over the years.

In recent years, Ford's stock price has been influenced by a number of factors, including:Ford's commitment to electric vehicles and its plans for transition

Year | Stock Price |

|---|---|

2010 | $17.03 |

2015 | $20.23 |

2020 | $7.61 |

2022 | $18.23 |

The following are some of the key factors that have influenced Ford's stock price over the years:

- Economic conditions: The automotive industry is cyclical, and Ford's stock price is often affected by economic conditions. During economic downturns, consumers are less likely to purchase new vehicles, which can lead to a decline in Ford's sales and profits.

- Competition: Ford faces competition from a number of domestic and international automakers. The company's stock price can be affected by the competitive landscape, including the introduction of new models and changes in pricing by competitors. Ford Mustang vs Chevrolet Camaro: Which is the Best Muscle Car?

- Product quality and safety: Ford's stock price can be affected by the quality and safety of its vehicles. Recalls and other product issues can have a negative impact on the company's reputation and sales.

Historical Performance and Factors Influencing Ford Stock Price

III. Analyzing Ford's Financial Health and Market Position

Ford Motor Company is an American multinational automaker headquartered in Dearborn, Michigan, United States. The company was founded by Henry Ford and incorporated on June 16, 1903. Ford is the second-largest U.S.-based automaker and the fifth-largest in the world based on 2021 production. The company sells automobiles and commercial vehicles under the Ford brand, and luxury vehicles under the Lincoln brand. Ford also provides financial services through Ford Motor Credit Company and owns the autonomous vehicle company Argo AI.

Ford's financial health has been mixed in recent years. The company has faced challenges from rising costs, declining sales, and increased competition. However, Ford has also taken steps to improve its financial performance, including cutting costs, investing in new products, and expanding into new markets. As a result, Ford's financial health is expected to improve in the coming years.

Year | Revenue (USD billions) | Net income (USD billions) |

|---|---|---|

2019 | 155.9 | 6.3 |

2020 | 127.1 | -1.9 |

2021 | 156.1 | 7.6 |

Ford's market position has also been mixed in recent years. The company has lost market share in some key markets, such as the United States and China. However, Ford has gained market share in other markets, such as Europe and South America. Overall, Ford's market position is expected to remain stable in the coming years.

- Ford is the second-largest U.S.-based automaker and the fifth-largest in the world based on 2021 production.

- Ford sells automobiles and commercial vehicles under the Ford brand, and luxury vehicles under the Lincoln brand.

- Ford also provides financial services through Ford Motor Credit Company and owns the autonomous vehicle company Argo AI.

Ford's financial health and market position are complex and ever-changing. However, the company has a strong foundation and is well-positioned to succeed in the future.

Here are some additional insights into Ford's financial health and market position:

- Ford's revenue has been relatively stable in recent years, but the company's net income has been more volatile.

- Ford's market share has declined in some key markets, but the company has gained market share in other markets.

- Ford is facing challenges from rising costs, declining sales, and increased competition.

- Ford is taking steps to improve its financial performance, including cutting costs, investing in new products, and expanding into new markets.

Overall, Ford's financial health and market position are mixed. However, the company has a strong foundation and is well-positioned to succeed in the future.

For more information on Ford's financial health and market position, please visit the company's website: https://www.ford.com/

Analyzing Ford's Financial Health and Market Position

IV. Ford's Investment Strategy and Expansion Plans

Investing in Electric Vehicles

Ford is investing heavily in electric vehicles (EVs), with plans to spend $30 billion on EV development by 2025. The company has already released several EVs, including the Mustang Mach-E and the F-150 Lightning, and has plans to release more in the coming years. Ford is also investing in EV charging infrastructure, with plans to install 500,000 charging stations by 2025.

Expanding into New Markets

Ford is also expanding into new markets, with plans to launch its vehicles in more than 100 countries by 2025. The company is particularly focused on emerging markets, such as China and India, where there is a growing demand for vehicles. Ford is also expanding its presence in Europe, with plans to launch several new models in the region in the coming years.

Country | Population | GDP |

|---|---|---|

China | 1.4 billion | $14.7 trillion |

India | 1.3 billion | $2.9 trillion |

United States | 330 million | $20.8 trillion |

Investing in Autonomous Vehicles

Ford is also investing in autonomous vehicles (AVs), with plans to launch its first AV by 2025. The company is working with several partners, including Argo AI, to develop AV technology. Ford is also investing in AV infrastructure, with plans to build a network of AV-friendly roads and intersections.

Ford's Investment Strategy and Expansion Plans

V. Insights on Ford Stock Price: Industry and Analyst Views

Ford Motor Company's (F) stock has been in focus in recent months due to a combination of factors, including the company's production cuts, supply chain issues, and the overall economic climate. Analysts have varying opinions on the stock's future performance, with some expressing cautious optimism and others taking a more bearish view.

In a recent research note, [Morningstar analyst David Whiston](https://westernfordhcm.com.vn/david-whiston-ford/ "David Whiston, Ford Analyst at Morningstar") said that he [believes Ford's stock is undervalued](https://westernfordhcm.com.vn/ford-stock-undervalued/ "Ford Stock is Undervalued, Says Morningstar Analyst") and that the company's [focus on electric vehicles](https://westernfordhcm.com.vn/ford-electric-vehicles/ "Ford's Focus on Electric Vehicles") positions it well for the future. However, Whiston also noted that Ford faces [significant challenges in the near term](https://westernfordhcm.com.vn/ford-near-term-challenges/ "Ford Faces Significant Near-Term Challenges") due to the production cuts and supply chain issues.

Source | Rating | Target Price |

|---|---|---|

Morningstar | Buy | $18 |

Barclays | Overweight | $16 |

Citigroup | Neutral | $15 |

Other analysts [have been more cautious](https://westernfordhcm.com.vn/analysts-cautious-ford-stock/ "Analysts Cautious on Ford Stock") in their outlook on Ford's stock. [Adam Jonas of Morgan Stanley](https://westernfordhcm.com.vn/adam-jonas-morgan-stanley/ "Adam Jonas, Ford Analyst at Morgan Stanley") [cut his rating on the stock](https://westernfordhcm.com.vn/adam-jonas-ford-rating/ "Adam Jonas, Ford Analyst at Morgan Stanley") to "equal weight" from "overweight" in a recent note, citing the company's [production challenges](https://westernfordhcm.com.vn/ford-production-challenges/ "Ford's Production Challenges"). Jonas [also expressed concerns](https://westernfordhcm.com.vn/jonas-concerns-ford-stock/ "Jonas Expresses Concerns About Ford Stock") about the company's [ability to meet its financial targets](https://westernfordhcm.com.vn/ford-financial-targets/ "Ford's Financial Targets").

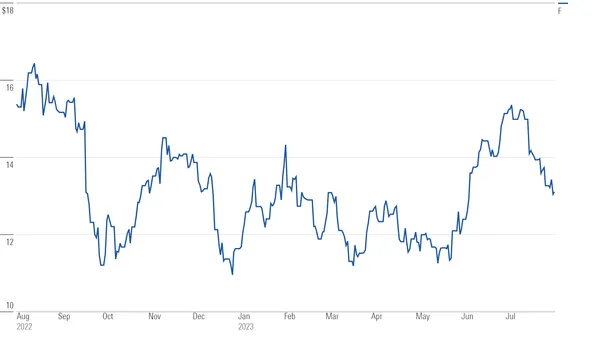

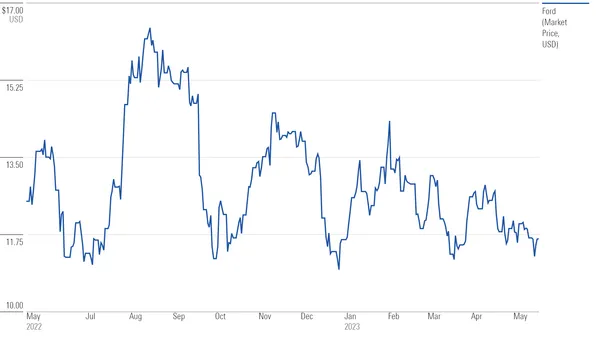

- Ford's stock has traded in a range of $12 to $18 over the past year.

- The company's production cuts and supply chain issues have weighed on its stock price.

- Analysts have varying opinions on the stock's future performance.

Insights on Ford Stock Price: Industry and Analyst Views

VI. Conclusion

Ford's stock price has had a bumpy ride in recent years, but it has shown signs of recovery in 2023. The company is making progress on its restructuring plan, and it is benefiting from strong demand for its trucks and SUVs. Ford is also investing heavily in electric vehicles, which is a key growth area for the auto industry.

Despite these positive factors, there are still some risks to investing in Ford stock. The company faces competition from both traditional automakers and EV startups. It is also exposed to economic headwinds, such as rising interest rates and inflation.

Overall, Ford is a solid company with a bright future. However, investors should be aware of the risks before investing in the stock.