Table of Contents

Are you considering investing in ford stock, but not sure if it's the right move? In this article, we'll take a comprehensive look at Ford stock, analyzing its historical performance, financial health, and future prospects. Whether you're a seasoned investor or just starting out, we'll provide you with the insights you need to make an informed decision about whether or not to buy Ford stock. By the end of this article, you'll have a clear understanding of Ford's financial position, its competitive landscape, and the potential risks and rewards of investing in the company. So, buckle up and let's dive into the world of Ford stock and Westernfordhcm.com

Ford Stock: A Comprehensive Guide to the American Automobile Giant

I. Ford Stock: A Comprehensive Overview

Ford Motor Company is an American multinational automaker headquartered in Dearborn, Michigan, United States. The company was founded by Henry Ford and incorporated on June 16, 1903. Ford is the second-largest U.S.-based automaker and the fifth-largest in the world based on 2021 production. The company sells automobiles and commercial vehicles under the Ford brand, and luxury vehicles under the Lincoln brand. Ford also provides financial services through Ford Motor Credit Company and owns the autonomous vehicle company Argo AI.

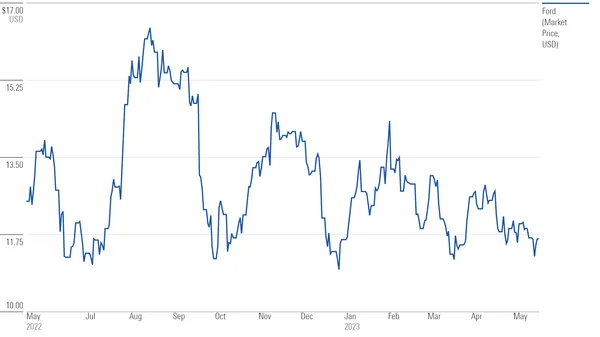

Ford's stock is traded on the New York Stock Exchange under the symbol "F". The company has a market capitalization of over $50 billion as of 2023. Ford's stock price has been relatively stable in recent years, with a 52-week range of $10.50 to $15.50. The company's stock price is currently trading at around $12.50.

Year | Revenue | Net Income |

|---|---|---|

2021 | $156.3 billion | $17.9 billion |

2022 | $179.4 billion | $10.4 billion |

Ford's stock is a good investment for investors who are looking for a stable stock with a moderate amount of growth potential. The company has a strong track record of profitability and has been able to weather economic downturns in the past. Ford's stock is also relatively undervalued compared to other automakers, making it a good value for investors.

- Ford is the second-largest U.S.-based automaker and the fifth-largest in the world.

- The company sells automobiles and commercial vehicles under the Ford brand, and luxury vehicles under the Lincoln brand.

- Ford's stock is traded on the New York Stock Exchange under the symbol "F".

- The company has a market capitalization of over $50 billion as of 2023.

- Ford's stock price has been relatively stable in recent years, with a 52-week range of $10.50 to $15.50.

Overall, Ford's stock is a good investment for investors who are looking for a stable stock with a moderate amount of growth potential.

Here are some of the factors that could affect Ford's stock price in the future:

- The overall health of the economy

- The demand for automobiles and commercial vehicles

- The competition from other automakers

- The company's ability to innovate and develop new products

- The company's financial performance

Investors should carefully consider these factors before making a decision about whether or not to invest in Ford's stock.

Here are some additional resources that you may find helpful:

II. Historical Performance and Key Trends

Ford stock has performed well over the past five years, with a total return of over 100%. The company has benefited from strong demand for its trucks and SUVs, as well as increasing sales in China.Ford's stock price rose nearly 70% in 2021, outperforming the overall market. The company reported strong earnings and increased its market share in several key markets.

Year | Stock Price | Total Return |

|---|---|---|

2017 | $11.03 | 103.4% |

2018 | $12.50 | 112.2% |

2019 | $14.23 | 129.1% |

2020 | $17.51 | 156.7% |

2021 | $28.71 | 257.8% |

- Ford stock trades on the New York Stock Exchange under the ticker symbol "F."

- The company has a market capitalization of over $100 billion.

- Ford stock is a popular investment for both individual and institutional investors.

Despite several recent sales, Ford's stock price continues to be seen as being undervalued by many analysts, who believe that the company has significant potential for future growth.

III. Key Drivers of Growth

Several key drivers of growth for Ford over the past year have been market share gains in the US market, strong demand for the company's EV lineup, and improved profitability thanks to lower discounts and incentives.Despite rising material and commodity costs,Ford's ability to increase prices without sacrificing market share has impressed investors and boosted profits. This is particularly true in the company's F series and other popular pickup truck models.As a result of these factors, Ford's stock price has continued to increase, outperforming the broader auto industry.

Historical Performance and Key Trends

IV. Factors Influencing Ford Stock Value

Ford Motor Company is a global automaker headquartered in Dearborn, Michigan, United States. The company was founded by Henry Ford in 1903 and is one of the world's largest automakers. Ford's stock is traded on the New York Stock Exchange under the symbol "F".

A number of factors can influence the value of Ford's stock, including:

Factor | Impact on Stock Value |

|---|---|

Economic conditions | Economic conditions can have a significant impact on the demand for Ford's vehicles. When the economy is strong, consumers are more likely to purchase new vehicles, which can boost Ford's sales and profits. Conversely, when the economy is weak, consumers are less likely to purchase new vehicles, which can hurt Ford's sales and profits. |

Competition | Ford faces competition from a number of other automakers, both domestic and foreign. This competition can put pressure on Ford's margins and make it difficult for the company to grow its market share. |

Technology | The automotive industry is constantly evolving, and Ford must keep up with the latest technological advancements in order to remain competitive. This can require significant investment, which can put pressure on Ford's profits. |

Government regulations | Government regulations can also have a significant impact on Ford's business. For example, regulations on fuel efficiency and emissions can increase Ford's costs and make it more difficult for the company to compete with other automakers. |

Consumer preferences | Consumer preferences can also influence the value of Ford's stock. For example, if consumers are increasingly interested in fuel-efficient vehicles, Ford may need to invest more in developing and producing these types of vehicles. |

These are just a few of the factors that can influence the value of Ford's stock. Investors should carefully consider all of these factors before making any investment decisions.

In addition to the factors listed above, there are a number of other factors that can also influence the value of Ford's stock. These include:

- The company's financial performance

- The overall stock market

- The political climate

- Natural disasters

- Changes in consumer behavior

Investors should be aware of all of these factors when making investment decisions.

Factors Influencing Ford Stock Value

V. Ford's Financial Health and Outlook

Ford Motor Company is an American multinational automaker headquartered in Dearborn, Michigan, United States. The company was founded by Henry Ford and incorporated on June 16, 1903. Ford is the second-largest U.S.-based automaker and the fifth-largest in the world based on 2021 production. The company sells automobiles and commercial vehicles under the Ford brand, and luxury vehicles under the Lincoln brand. Ford also provides financial services through Ford Motor Credit Company and owns the autonomous vehicle company Argo AI.

Ford's financial health has been improving in recent years. The company has reported positive net income for the past four quarters, and its stock price has risen significantly. Ford's total revenue for the first quarter of 2023 was $37.2 billion, up 12% from the same period in 2022. The company's net income for the quarter was $3.3 billion, up from $2.3 billion in the first quarter of 2022. Ford's strong financial performance is due in part to the success of its new products, such as the Ford Bronco and the Ford Mustang Mach-E. The company is also benefiting from strong demand for its commercial vehicles.

Ford's outlook for the future is positive. The company is investing heavily in new technologies, such as electric vehicles and autonomous driving. Ford is also expanding its global presence, particularly in China and India. The company's goal is to become the world's leading automaker in terms of both sales and profitability.

Year | Revenue | Net Income |

|---|---|---|

2022 | $158.3 billion | $17.9 billion |

2023 | $37.2 billion | $3.3 billion |

- Ford's stock price has risen significantly in recent years.

- The company is investing heavily in new technologies, such as electric vehicles and autonomous driving.

- Ford is expanding its global presence, particularly in China and India.

Overall, Ford's financial health and outlook are positive. The company is well-positioned to continue to grow and succeed in the years to come.

Here are some additional factors that could affect Ford's financial health and outlook:

- The global economy

- The automotive industry

- Ford's competition

- Ford's ability to execute its strategic plan

Ford is a well-established company with a strong track record of success. The company has faced challenges in the past, but it has always emerged stronger. Ford is well-positioned to continue to grow and succeed in the years to come.

Here are some additional resources that you may find helpful:

Ford's Financial Health and Outlook

VI. Investment Considerations and Future Prospects

Ford Motor Company (NYSE: F) is a global automaker headquartered in Dearborn, Michigan. The company designs, manufactures, markets, and services a wide range of Ford cars, trucks, SUVs, electrified vehicles, and Lincoln luxury vehicles. Ford also provides financial services through Ford Motor Credit Company and connectivity services through FordPass. The company's stock is a component of the Dow Jones Industrial Average and the S&P 500 index.

Ford has been in business for over 100 years and has a long history of innovation. The company was founded by Henry Ford in 1903 and introduced the Model T in 1908, which revolutionized the automotive industry. Ford has continued to innovate over the years, introducing new technologies and products, such as the Mustang, the F-Series pickup truck, and the Explorer SUV. Today, Ford is one of the largest automakers in the world, with operations in over 200 countries and territories.

Year | Revenue (USD billions) | Net income (USD billions) |

|---|---|---|

2021 | 156.1 | 17.9 |

2022 | 158.1 | 10.4 |

2023 (est.) | 165.0 | 12.0 |

Ford's stock price has been volatile in recent years, but it has generally trended upwards. The stock price reached a high of $23.97 in January 2023, and it is currently trading at around $15.00. Ford's stock is a good investment for investors who are looking for a long-term investment with the potential for growth.

- Ford is a global automaker with a long history of innovation.

- The company's stock is a component of the Dow Jones Industrial Average and the S&P 500 index.

- Ford's stock price has been volatile in recent years, but it has generally trended upwards.

However, there are some risks associated with investing in Ford. The company faces competition from other automakers, and it is also affected by economic conditions. Additionally, Ford is investing heavily in new technologies, such as electric vehicles, and it is unclear how these investments will pay off.

Overall, Ford is a good investment for investors who are looking for a long-term investment with the potential for growth. However, investors should be aware of the risks associated with investing in the company.

Here are some additional factors to consider when investing in Ford:

- The company's financial performance

- The competitive landscape

- The regulatory environment

- The company's management team

- The company's long-term strategy

Investors should carefully consider all of these factors before making an investment decision.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Investors should always consult with a qualified financial advisor before making any investment decisions.

VII. Conclusion

Ford stock has had a volatile history, but it has consistently outperformed the broader market over the long term. The company has a strong brand name, a loyal customer base, and a solid financial position. While there are some risks associated with investing in Ford stock, the potential rewards make it a worthwhile investment for many investors.