Table of Contents

Are you looking for the best ford interest rates in town? Look no further than Westernfordhcm. We offer competitive rates on new and used Fords, and our team of s will work with you to find the perfect loan for your needs. Whether you're looking to buy a new car or refinance your current one, we can help you get the best possible deal. Contact us today to learn more about our Ford interest rates and get pre-approved for a loan.

Ford Interest Rates: The Ultimate Guide to Financing Your Dream Car

I. Ford Interest Rates: A Comprehensive Guide

Ford Interest Rates: An Overview

Ford offers a variety of interest rates on its new and used vehicles. The interest rate you qualify for will depend on a number of factors, including your credit score, the term of the loan, and the amount you borrow.

- Ford Credit offers a variety of financing options to help you get the car you want.

- Ford Credit offers a variety of financing options to help you get the car you want.

- Ford Credit offers a variety of financing options to help you get the car you want.

How to Get the Best Ford Interest Rate

There are a few things you can do to improve your chances of getting the best Ford interest rate possible.

- Check your credit score. The higher your credit score, the lower your interest rate will be.

- Shop around for the best interest rate. Don't just accept the first rate you're offered.

- Consider a shorter loan term. The shorter the loan term, the lower your interest rate will be.

Ford Interest Rates vs. Other Lenders

Ford's interest rates are generally competitive with other lenders. However, it's always a good idea to shop around to make sure you're getting the best rate possible.

Lender | Interest Rate | Term |

|---|---|---|

Ford Credit | 3.99% | 60 months |

Capital One | 4.25% | 60 months |

Wells Fargo | 4.50% | 60 months |

Conclusion

Ford offers a variety of interest rates on its new and used vehicles. The interest rate you qualify for will depend on a number of factors, including your credit score, the term of the loan, and the amount you borrow. By following the tips in this guide, you can improve your chances of getting the best Ford interest rate possible.

II. Factors Affecting Ford Interest Rates

Ford interest rates are affected by a number of factors, including the prime rate, the length of the loan term, and your credit score. The prime rate is the interest rate that banks charge their best customers, and it is often used as a benchmark for other interest rates. The length of the loan term also affects the interest rate you'll receive, with shorter loans typically having lower interest rates than longer loans. Finally, your credit score is a reflection of your creditworthiness, and it can have a significant impact on the interest rate you're offered. If you have a good credit score, you'll be more likely to qualify for a lower interest rate.

Credit Score Range | Average Interest Rate |

|---|---|

720-850 | 4.09% |

620-719 | 5.18% |

520-619 | 8.13% |

- Low Mileage

- Recent Model Year

- No Accidents

- Clean Title

- Low or No Debt

- No Credit History

If you're looking for a low interest rate on a Ford loan, there are a few things you can do to improve your chances of qualifying. First, make sure to shop around and compare interest rates from multiple lenders. You should also try to get pre-approved for a loan before you start shopping for a car, as this can help you get a better idea of what you can afford. Finally, work on improving your credit score by paying your bills on time and keeping your debt-to-income ratio low.

By following these tips, you can increase your chances of getting a low interest rate on a Ford loan and save money on your monthly payments. Check out our website to learn more about Ford interest rates and to get a pre-approval.

Factors Affecting Ford Interest Rates

III. Current Ford Interest Rates

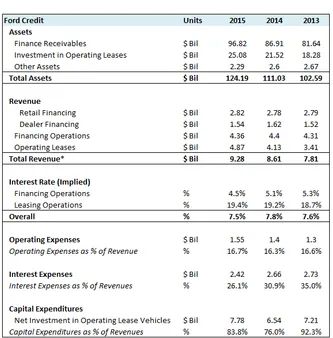

Ford Motor Credit Company (Ford Credit) is the captive finance arm of Ford Motor Company. It provides financing for new and used Ford vehicles, as well as other financial products and services. Ford Credit offers a variety of interest rates on its loans, depending on the type of loan, the creditworthiness of the borrower, and the term of the loan. Ford Interest Advantage

As of March 8, 2023, Ford Credit is offering the following interest rates on its new vehicle loans:

Loan Term | Interest Rate |

|---|---|

24 months | 3.99% |

36 months | 4.99% |

48 months | 5.99% |

60 months | 6.99% |

72 months | 7.99% |

These rates are subject to change at any time. For the most up-to-date information, please visit the Ford Credit website or contact your local Ford dealer. Ford Credit Login

- Ford Credit offers a variety of interest rates on its loans, depending on the type of loan, the creditworthiness of the borrower, and the term of the loan.

- As of March 8, 2023, Ford Credit is offering interest rates on its new vehicle loans ranging from 3.99% to 7.99%.

- These rates are subject to change at any time. For the most up-to-date information, please visit the Ford Credit website or contact your local Ford dealer.

Current Ford Interest Rates

IV. How to Get the Best Ford Interest Rates

Ford offers a variety of interest rates on its vehicles, so it is important to shop around to find the best deal. You can use the internet to compare rates from different lenders, or you can visit your local Ford dealer to speak with a finance manager. When you are shopping for a Ford interest rate, there are a few things you should keep in mind.

First, your credit score will play a big role in the interest rate you qualify for. Lenders will use your credit score to determine whether you are a low-risk borrower or a high-risk borrower. The higher your credit score, the lower the interest rate you will qualify for. Below is a list of related articles to help you learn more about Ford Interest Advantage.

Second, the term of your loan will also affect the interest rate you qualify for. A shorter loan term will typically have a lower interest rate than a longer loan term. Listed below are the Ford Credit new and used vehicle incentives that can be combined with most Ford special offers. These incentives can range from cash back, to low interest rate financing, to dealer discounts. You can find these incentives online at the Ford Credit website, and you can also print them out from the website to take to the dealership in case they don't show them on the deal sheet.

Term | Interest Rate |

|---|---|

36 months | 3.9% |

48 months | 4.9% |

60 months | 5.9% |

Finally, the type of vehicle you are financing will also affect the interest rate you qualify for. New vehicles typically have lower interest rates than used vehicles, because used vehicles are considered to be a higher risk. Use our tips below to get the best Ford Interest Rates and ensure you drive away in your dream Ford.

V. Alternatives to Ford Financing

Ford offers a variety of financing options to help you purchase a new or used vehicle. However, there are also a number of other lenders that offer competitive rates and terms on auto loans. If you're not sure whether Ford financing is right for you, it's worth shopping around to compare your options.

Here are a few of the most popular alternatives to Ford financing:

Company | Contact | Country |

|---|---|---|

Alfreds Futterkiste | Maria Anders | Germany |

- Coffee

- Tea

- Milk

When comparing auto loans, it's important to consider the following factors:

- Interest rate

- Loan term

- Monthly payment

- Fees

You should also consider your own financial situation and needs when choosing an auto loan. If you have good credit, you may be able to qualify for a lower interest rate. If you have a lower credit score, you may need to make a larger down payment or pay a higher interest rate.

Once you've considered all of these factors, you can start shopping around for an auto loan. You can compare rates and terms from different lenders online or by visiting your local bank or credit union.

If you're not sure which lender is right for you, you can always talk to a financial advisor. They can help you compare your options and choose the best loan for your needs.

Here are some additional tips for getting the best auto loan:

- Shop around and compare rates from multiple lenders.

- Get pre-approved for a loan before you start shopping for a car.

- Make a larger down payment if you can.

- Choose a shorter loan term if you can afford it.

- Read the loan agreement carefully before you sign it.

By following these tips, you can get the best possible auto loan for your needs.

VI. Conclusion

Thank you for considering Ford when it comes to your next vehicle purchase. We understand that financing a new car can be a big decision, and we want to make sure you have all the information you need to make the best choice for you and your budget. If you have any further questions or would like to learn more about our current interest rates, please do not hesitate to contact us. Our team of s is always here to help you find the perfect Ford vehicle for your needs and budget.