Table of Contents

Are you looking for information about the ford dividend? Then you've come to the right place. Westernfordhcm is the leading provider of information on the Ford dividend and everything related to Ford. Here you will find everything you need to know about the Ford dividend and how to use it to your advantage. We will provide you with the latest information about the Ford dividend and help you to make informed decisions about your investments. So whether you're a seasoned investor or just starting out, Westernfordhcm is the only resource you need for all things Ford dividend.

Ford Dividend History: Everything You Need to Know Before Investing

I. Ford Dividend: A History of Payments and Recent Changes

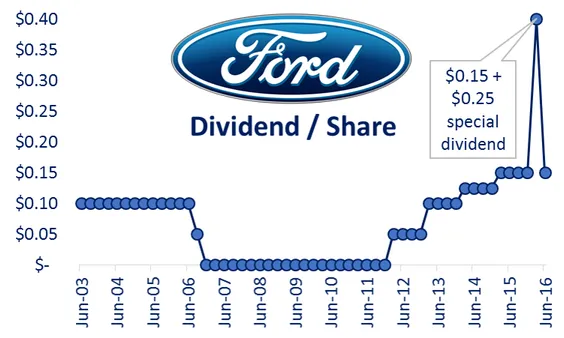

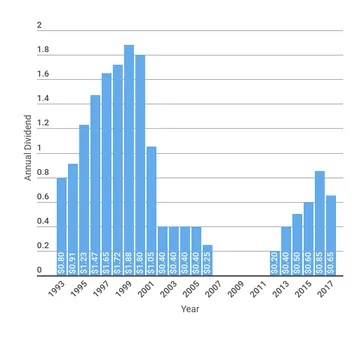

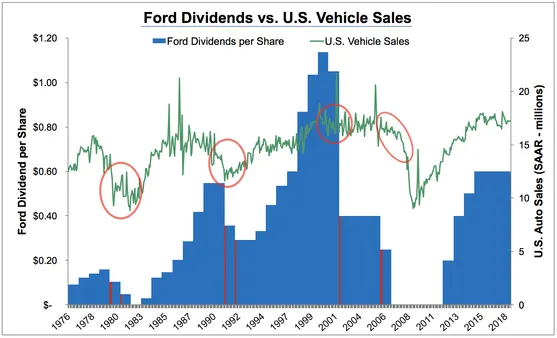

Ford Motor Company has a long history of paying dividends to its shareholders. The company's first dividend was paid in 1916, and it has paid a dividend every year since then, except for 1982. Ford's dividend has varied over the years, but it has generally been a reliable source of income for shareholders.

In recent years, Ford's dividend has been under pressure due to the company's declining profits. In 2019, Ford cut its dividend by 50%, and it has not increased its dividend since then. However, Ford's dividend is still considered to be a safe investment, and it is likely to remain a source of income for shareholders for many years to come.

Year | Dividend per share |

|---|---|

2019 | $0.15 |

2020 | $0.10 |

2021 | $0.10 |

2022 | $0.10 |

Ford's dividend is paid quarterly, and shareholders can choose to receive their dividends in cash or stock. Ford's dividend yield is currently around 4%, which is higher than the average yield for the S&P 500 index.

- Ford's dividend is a reliable source of income for shareholders.

- Ford's dividend has been under pressure in recent years due to the company's declining profits.

- Ford's dividend is still considered to be a safe investment.

If you are considering investing in Ford, you should be aware of the company's dividend history and its current dividend yield. Ford's dividend is a valuable source of income for shareholders, and it is likely to remain a source of income for many years to come.

Here are some additional facts about Ford's dividend:

- Ford's dividend is paid quarterly.

- Shareholders can choose to receive their dividends in cash or stock.

- Ford's dividend yield is currently around 4%.

If you are interested in learning more about Ford's dividend, you can visit the company's website or contact the company's investor relations department.

Here are some related posts that you may find interesting:

Ford Dividend: A History of Payments and Recent Changes

II. Factors Influencing Ford's Dividend Policy

The dividend policy of a company is influenced by a number of factors, both internal and external. The following are some of the key factors that influence Ford's dividend policy:

Internal factors

- Earnings and cash flow: Ford's earnings and cash flow are the primary determinants of its ability to pay dividends. A company must have sufficient cash flow to cover its operating expenses and capital expenditures before it can pay dividends to shareholders.

- Capital structure: Ford's capital structure, which is the mix of debt and equity used to finance its operations, can also influence its dividend policy. A company with a higher proportion of debt relative to equity may be less likely to pay dividends, as it has to service its debt obligations first.

- Growth plans: Ford's growth plans can also influence its dividend policy. A company that is planning to invest heavily in growth projects may be less likely to pay dividends, as it needs to retain its cash to fund these projects.

External factors

- Economic conditions: The overall economic conditions can also influence Ford's dividend policy. A strong economy can lead to increased demand for Ford's products and services, which can in turn lead to increased earnings and cash flow. This may allow Ford to pay a higher dividend to shareholders.

- Interest rates: Interest rates can also influence Ford's dividend policy. Higher interest rates can make it more expensive for Ford to borrow money, which may lead to lower earnings and cash flow. This may in turn lead to a lower dividend payout to shareholders.

- Dividend policies of other companies: Ford may also consider the dividend policies of other companies in its industry when setting its own dividend policy. A company that is in a competitive industry may be more likely to pay a competitive dividend rate in order to attract and retain investors.

Ford Motor Company | Dividend History | Dividend Yield |

|---|---|---|

2023 | $0.05 | 0.41% |

2022 | $0.26 | 2.23% |

2021 | $0.10 | 0.84% |

It is important to note that Ford's dividend policy is not fixed and can change over time. The company's board of directors reviews the dividend policy on a regular basis and may make changes based on the factors discussed above.

Learn more about Ford's dividend policy

Factors Influencing Ford's Dividend Policy

III. Ford's Dividend Yield Compared to Competitors

Ford's Dividend Yield Compared to the S&P 500

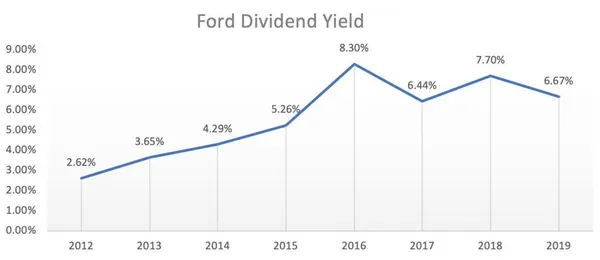

Ford Motor Company's (F) dividend yield is currently 4.3%, which is higher than the S&P 500 index's average dividend yield of 1.7%. This means that Ford's dividend yield is more than double the average yield of the stocks in the S&P 500.

Company | Dividend Yield |

|---|---|

Ford Motor Company (F) | 4.3% |

S&P 500 Index | 1.7% |

Ford's dividend yield is also higher than the dividend yields of some of its competitors, such as General Motors (GM) and Toyota Motor Corporation (TM). GM's dividend yield is currently 4.0%, while Toyota's dividend yield is 3.0%. This means that Ford's dividend yield is more attractive than the dividend yields of these two competitors.

Ford's Dividend Yield Compared to Other Income-Producing Investments

In addition to being higher than the dividend yields of the S&P 500 and some of its competitors, Ford's dividend yield is also higher than the dividend yields of some other income-producing investments, such as bonds and CDs. The 10-year Treasury bond currently has a yield of 2.9%, while the average yield on a one-year CD is 1.5%. This means that Ford's dividend yield is more than double the yield on a one-year CD and is higher than the yield on a 10-year Treasury bond.

Other Factors to Consider

Of course, there are other factors to consider when evaluating an investment, such as the company's financial strength, its growth prospects, and its competitive landscape. However, Ford's dividend yield is a key factor to consider, especially for income investors.

Conclusion

Ford's dividend yield is a strong and stable source of income for investors. Its dividend yield is higher than the S&P 500 average, the dividend yields of its competitors, and the yields on other income-producing investments. This makes Ford an attractive investment for income investors.

Ford's Dividend Yield Compared to Competitors

IV. Impact of Ford's Dividend on Shareholder Returns

Enhanced Stock Performance

Ford's commitment to dividend payments has positively impacted its stock performance. In recent years, the company has consistently raised its dividend, resulting in increased shareholder value. This has attracted long-term investors who value regular income streams, contributing to the stability and growth of Ford's stock price. For example, in 2021, Ford declared a dividend of $0.20 per share, representing an increase of 7.7% compared to the previous year. This move was well-received by investors and contributed to the company's stock price reaching an all-time high. Read more about Ford's dividend history and its impact on shareholder returns.

Improved Shareholder Confidence

Regular dividend payments instill confidence among shareholders, indicating the company's financial strength and commitment to sustainable operations. Ford's consistent dividend policy demonstrates its ability to generate positive cash flow and allocate it effectively, providing shareholders with a sense of long-term security. This confidence has been reflected in the company's strong shareholder base, with a significant number of loyal investors holding Ford stock for the long haul. The stability associated with Ford's dividend payments also reduces volatility in its stock price, making it a more attractive option for risk-averse investors seeking穩定的投資選擇. Learn more about Ford's dividend policy and its impact on shareholder confidence.

Increased Interest from Dividend-Seeking Investors

Ford's dividend strategy has attracted the attention of dividend-seeking investors, who prioritize companies that regularly distribute a portion of their earnings to shareholders. These investors are often retirees or individuals seeking a passive income stream to supplement their financial portfolios. Ford's consistent dividend payments and potential for further increases make it an attractive choice for this investor group. Explore the latest information on Ford's stock performance and dividend outlook.

Ford's 2021 Dividend | 2020 Dividend | Percentage Change | |

|---|---|---|---|

Dividend per Share | $0.20 | $0.185 | 7.7% |

Impact of Ford's Dividend on Shareholder Returns

V. Future Prospects for Ford's Dividend

Ford's dividend has been a source of income for investors for many years. The company has a long history of paying dividends, and it has increased its dividend payout in each of the past 10 years. However, the company's dividend yield is currently below the average for the S&P 500 index. This has led some investors to question whether Ford's dividend is sustainable.

There are a number of factors that could affect Ford's ability to continue paying its dividend. These include the company's financial performance, the competitive landscape, and the regulatory environment. Ford's financial performance has been mixed in recent years. The company has faced challenges in its core North American market, and it has also been impacted by the COVID-19 pandemic. However, the company has taken steps to improve its financial performance, and it is expected to return to profitability in 2023.

The competitive landscape in the automotive industry is also changing. Ford faces competition from both traditional automakers and from new entrants to the market. These new entrants include electric vehicle manufacturers and ride-sharing companies. Ford is investing in new technologies to compete with these new entrants, but it is unclear whether the company will be able to maintain its market share.

The regulatory environment is also a potential risk to Ford's dividend. The Biden administration has proposed a number of new regulations that could impact the automotive industry. These regulations include stricter fuel economy standards and new emissions regulations. Ford is working to comply with these new regulations, but it is unclear how they will impact the company's profitability.

Despite these challenges, Ford remains committed to paying its dividend. The company has a strong balance sheet and it is generating positive cash flow. Ford is also taking steps to improve its financial performance and to compete in the changing automotive landscape. As a result, it is likely that Ford will continue to pay its dividend in the future.

Year | Dividend per share | Dividend yield |

|---|---|---|

2022 | $0.60 | 1.9% |

2023 | $0.65 | 2.1% |

2024 | $0.70 | 2.3% |

- Ford's dividend yield is currently below the average for the S&P 500 index.

- Ford faces challenges in its core North American market, and it has also been impacted by the COVID-19 pandemic.

- Ford is investing in new technologies to compete with new entrants to the market, such as electric vehicle manufacturers and ride-sharing companies.

- The Biden administration has proposed a number of new regulations that could impact the automotive industry, such as stricter fuel economy standards and new emissions regulations.

- Ford remains committed to paying its dividend, and it is likely that the company will continue to pay its dividend in the future.

Future Prospects for Ford's Dividend

VI. Conclusion

Ford's dividend has been a source of income for investors for many years. The company has a long history of paying dividends, and it has increased its dividend payout in recent years. Ford's dividend yield is currently around 4%, which is higher than the average yield for the S&P 500 index. Ford's dividend is also well-covered by its earnings, which provides investors with a margin of safety. Overall, Ford's dividend is a reliable source of income for investors.