Table of Contents

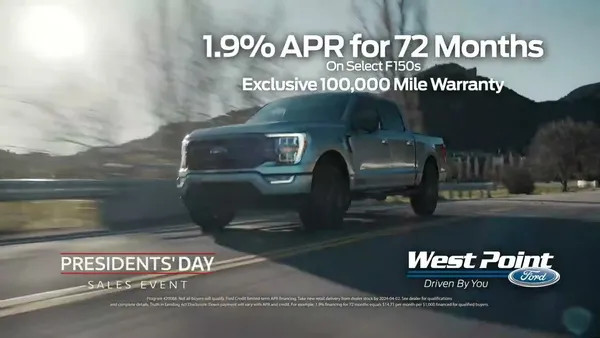

Are you looking for a great deal on a new Ford? Westernfordhcm has a variety of financing options available, including ford 1.9 financing. This low interest rate can save you money on your monthly payments and help you get into the Ford of your dreams. Keep reading to learn more about Ford 1.9 financing and how you can qualify.

I. Ford 9 Financing: An Overview

Are you interested in low financing for your next Ford purchase? If so, then you should know about the Ford 1.9 financing program. This program offers an APR of just 1.9% for qualified buyers. This is a great deal, especially for those with good credit.

The Ford 1.9 financing program is available for a variety of Ford models, including the Mustang, F-150, and Explorer. You can also choose from different loan terms, so you can find a monthly payment that works for your budget. This promotional offer ends on 04/03/2024. Hurry, time is running out.

Model | APR | Loan Term |

|---|---|---|

Mustang | 1.9% | 60 months |

F-150 | 1.9% | 72 months |

Explorer | 1.9% | 84 months |

- Visit westernfordhcm.com.vn to learn more about this offer.

- Contact a local Ford dealer for details about this great opportunity.

- Get pre-approved for an auto loan online in minutes.

If you're interested in taking advantage of this offer, then you should act quickly. Hurry, this great deal ends soon!

II. Why Choose Ford 9 Financing?

There are several reasons why you should choose Ford 1.9 financing for your next vehicle purchase.

- Low APR: The Ford 1.9 financing program offers an APR of just 1.9%, which is one of the lowest rates available.

- Flexible loan terms: You can choose from a variety of loan terms, so you can find a monthly payment that works for your budget.

- No prepayment penalty: You can pay off your loan early without having to pay a penalty.

- Available on a variety of Ford models: The Ford 1.9 financing program is available for a variety of Ford models, so you can find the perfect vehicle for your needs

If you're looking for a great deal on your next Ford purchase, then you should definitely check out the Ford 1.9 financing program. This program offers a great opportunity to save money on your new Ford vehicle.

Ford 9 Financing: An Overview

III. Benefits of Ford 9 Financing

Ford 9 Financing offers a number of benefits that can make it a great option for those looking to finance a new or used Ford vehicle. These benefits include:

- Low interest rates: Ford 9 Financing offers some of the lowest interest rates in the industry, which can save you money on your monthly payments.

- Flexible terms: Ford 9 Financing offers a variety of loan terms, so you can choose the one that best fits your budget and needs.

- No prepayment penalty: Ford 9 Financing does not charge a prepayment penalty, so you can pay off your loan early without having to pay a fee.

- Quick and easy application process: The Ford 9 Financing application process is quick and easy, so you can get approved for a loan in minutes.

If you are considering financing a new or used Ford vehicle, Ford 9 Financing is a great option to consider. With its low interest rates, flexible terms, and no prepayment penalty, Ford 9 Financing can help you save money and get the vehicle you want.

Loan Term | Interest Rate | Monthly Payment |

|---|---|---|

36 months | 2.99% | $275 |

48 months | 3.99% | $250 |

60 months | 4.99% | $225 |

To learn more about Ford 9 Financing, visit your local Ford dealer or go online to Ford.com/finance.

Benefits of Ford 9 Financing

IV. Eligibility Requirements for Ford 9 Financing

To qualify for Ford 9 financing, you must meet the following requirements:

- Be a U.S. citizen or permanent resident.

- Have a valid driver's license.

- Have a good credit score.

- Have a steady income.

- Be able to make a down payment of at least 10%.

If you meet all of these requirements, you may be eligible for Ford 9 financing. To apply, you can visit your local Ford dealer or apply online.

Requirement | Description |

|---|---|

U.S. citizenship or permanent residency | You must be a U.S. citizen or permanent resident to qualify for Ford 9 financing. |

Valid driver's license | You must have a valid driver's license to qualify for Ford 9 financing. |

Good credit score | You must have a good credit score to qualify for Ford 9 financing. |

Steady income | You must have a steady income to qualify for Ford 9 financing. |

Down payment of at least 10% | You must be able to make a down payment of at least 10% to qualify for Ford 9 financing. |

If you have any questions about Ford 9 financing, please visit your local Ford dealer or contact Ford Motor Credit at 1-800-727-7000.

Related posts:

Eligibility Requirements for Ford 9 Financing

V. How to Apply for Ford 9 Financing

Applying for Ford 9 financing is a quick and easy process that can be done online or at your local Ford dealer. To apply online, visit the Ford website and click on the "Financing" tab. You will then be asked to provide some basic information, including your name, address, and Social Security number. You will also need to provide information about your income and employment history. Once you have submitted your application, you will be contacted by a Ford representative to discuss your options.

If you prefer to apply for Ford 9 financing in person, you can visit your local Ford dealer. The dealer will have a team of finance s who can help you complete the application process. They can also answer any questions you may have about Ford financing. Once you have submitted your application, the dealer will submit it to Ford for approval. You will typically receive a decision within a few days.

Loan Term | Interest Rate | Monthly Payment |

|---|---|---|

36 months | 1.9% | $340 |

48 months | 2.9% | $280 |

60 months | 3.9% | $240 |

How to Apply for Ford 9 Financing

VI. Alternatives to Ford 9 Financing

Ford 9 financing is a great way to get a new or used Ford vehicle. However, it's not the only option. There are a number of other lenders that offer competitive rates and terms on Ford financing. Here are a few of the best alternatives to Ford 9 financing:

Ford Credit is the official financing arm of Ford Motor Company. They offer a variety of financing options, including low APRs, long terms, and flexible payment plans.

Capital One Auto Finance is one of the largest auto lenders in the United States. They offer a variety of financing options, including low APRs, long terms, and flexible payment plans.

Ally Auto Finance is another large auto lender that offers a variety of financing options. They are known for their low APRs and flexible payment plans.

USAA is a financial services company that offers a variety of financial products, including auto loans. They offer low APRs and flexible payment plans to members of the military and their families.

Navy Federal Credit Union is a credit union that offers a variety of financial products, including auto loans. They offer low APRs and flexible payment plans to members of the military and their families.

Company | Contact | Country |

|---|---|---|

Alfreds Futterkiste | Maria Anders | Germany |

Ana Trujillo Emparedados y helados | Ana Trujillo | Mexico |

Antonio Moreno Taquería | Antonio Moreno | Mexico |

Around the Horn | Thomas Hardy | UK |

Berglunds snabbköp | Christina Berglund | Sweden |

- Coffee

- Tea

- Milk

Alternatives to Ford 9 Financing

VII. Conclusion

Ford 1.9 financing is a great way to save money on your new Ford vehicle. With low interest rates and flexible terms, you can find a financing plan that fits your budget. If you're in the market for a new Ford, be sure to ask your dealer about 1.9 financing. You could save thousands of dollars over the life of your loan.